Bretton Woods Accord

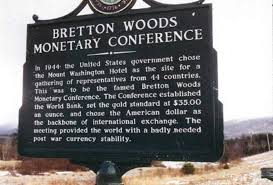

Just before World War 2 (1944), representatives from the allied nations (U.S, Great Britain and France) reach a conclusion that there was a need to set up a monetary system. These representatives got together at Bretton Woods, New Hampshire, to establish the policy of attaching currencies against the U.S Dollar.

The Bretton Woods System was established to fix exchange rates for major currencies and additionally led to the shaping of three international organizations, the International Monetary Fund (IMF), the International Bank for Reconstruction and Development, and the General Agreement on Tariffs and Trade (GATT). Moreover, the US Dollar replaced the Gold Standard to become a primary reserve currency and also to be the only currency that would be backed up by gold.

However, the years to come found the U.S having to deal with a series of balance payment deficits, trying to hold the position of the world’s dominant currency. In the early 1970s, the U.S went short of gold reserves and did not have enough gold to cover up all the U.S Dollars that foreign central banks had in reserve.

Finally, on the 15th of August 1971, U.S President Nixon announced that the world would no longer exchange gold for the U.S Dollars and this event marked the end of Bretton Woods’s era.